Saving your money with every purchase

What is an etr machine?

An Electronic Tax Register (ETR) is a type of cash register used to record sales and provide ETR receipt Kenya to customers. The registers also issue daily sales reports and stores information on stocks and sales. ETRs are built with Fiscal Memory, a unique type of read only memory (ROM). It stores tax-related information created each time a service or product is sold.

Although ETR machines can be added to networks, they can also be operated as standalone devices. An ETR machine is built with various security attributes, including memory, seal, unique technical specifications and serial numbers, among others.

Unlike Electronic Cash Registers (ECR), ETR machines are falsification-proof and thus they come highly recommended in Kenya. They feature tax memory that’s built to store information related to tax. The programmable read only memory (PROM or EPROM) can store up to 1800 days of transactions or a minimum of 5 years-worth of transactions.

The machines produce easily-identifiable fiscal receipts to support the generation of fiscal summary on a daily basis. It also comes in handy during tax-compliance inspections

What do you require before we can issue you with an ETR machine?

We require a scanned copy of your KRA Pin certificate. The certificate must have value added tax (VAT) obligations for it to be used for fictionalization. Click this link to download your KRA pin certificate.

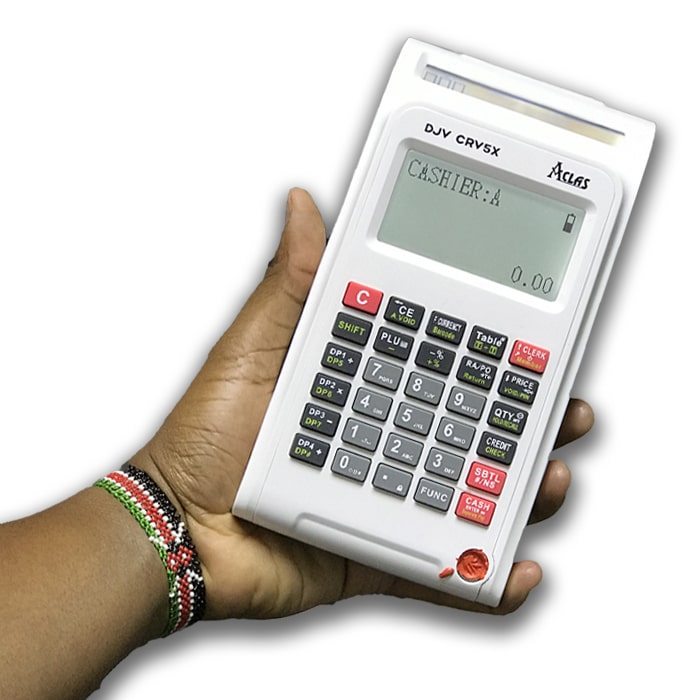

Aclas ETR machine

ACLAS is currently the best selling brand of etr in Kenya.

The ETR machine has superiority compared to other brands in terms of

- Shows the subtotal amount ,total tax, and the total amount

- Deducts 8% fuel levy in 3 step procedure

- Gives detailed departmental reports

- The printing quality is good and last long without fading

- long lasting internal battery.printing upto 600 receipts before recharge

- small size hence can be used in the field

- It can be used with a cash drawer

- Programmed to be used by many different clerks

- Works as a calculator, operating arithmetic on the keypad directly..

- Programmed to deduct catering and service charge hence suitable in hotels and restaurants.

- Can correct errors in case of a mistake

- Gives a duplicate of the ETR receipt

- can be able to reprint an earlier receipt in case it gets lost.

- Its meets all requirements by Kenya Revenue Authority hence a KRA approved ETR machine

The ETR machine is suitable for use in:

- Petrol stations

- mini size Supermarket

- Warehouse

- wholesale outlets

- retail shops

- restaurants

- Hotels

- Hospitals / chemists

- School / Education Institution

- Government offices

Aclas ETR machine user manual

How to do a z-report with an Aclas Etr Machine

- Turn on the ETR. (The power button is located at the back of the machine next to the charging port).

- Press the red clerk button. (ETR should display z-mode as the first item on the list)

- Press CASH button while on z-mode.

- If promoted for a password, enter 0000 then press CASH button. If not prompted for a password. Skip this step.

- Your etr machine should now be displaying Daily z on the screen.

- Press CASH button to produce your daily z receipt.

Types of sales that can be done with an Aclas ETR machine

- Vatable sale (14% VAT).

- Zero rated Sale.

- Exempt Sale.

- Catering levy (2%)

- Fuel (8%)

Where are the different types of sales mapped on the Aclas etr machine

- Vatable sale (14% VAT). Mapped to DP1

- Zero rated Sale. Mapped to DP2

- Exempt Sale. Mapped to DP3

- Catering levy (2%). Mapped to Dp4

- Fuel (8%). Mapped to DP4

**Please note the mapping may change depending on the customer **

How to do a vatable sale

- Turn on the ETR machine. (The power button is located at the back of the etr machine next to the charging port).

- Ensure that the screen is displaying CLERK 1

- If on another screen, press the Red C Button until the screen displays CLERK 1

- Now key in the Amount you want to produce the etr receipt for. (The amount keyed in should ALWAYS be INCLUSIVE of VAT)

- Press DP1 Button

- Press CASH button to print the receipt.

- Immediately tear of the receipt and press CASH button again to produce a duplicate receipt.

How to do a Zero rated sale

- Turn on the machine. (The power button is located at the back of the etr machine next to the charging port).

- Ensure that the screen is displaying CLERK 1

- If on another screen, press the Red C Button until the screen displays CLERK 1

- Now key in the Amount you want to produce the etr receipt for.

- Press DP2 Button

- Press CASH button to print the receipt.

- Immediately tear of the receipt and press CASH button again to produce a duplicate receipt.

How to do a tax exempted sale

- Turn on the ETR machine. (The power button is located at the back of the etr machine next to the charging port).

- Ensure that the screen is displaying CLERK 1

- If on another screen, press the Red C Button until the screen displays CLERK 1

- Now key in the Amount you want to produce the etr receipt for.

- Press DP3 Button

- Press CASH button to print the receipt.

- Immediately tear of the receipt and press CASH button again to produce a duplicate receipt.

How to do a catering levy sale on an Aclas etr Machine

- Please note. we map either fuel or catering levy to DP4 depending on the customer needs. If you did not buy the ETR Machine from us, please confirm how the two taxes were mapped on your etr machine before following this manual.

- Turn on the machine. (The power button is located at the back of the etr machine next to the charging port).

- Ensure that the screen is displaying CLERK 1

- If on another screen, press the Red C Button until the screen displays CLERK 1

- Now key in the Amount you want to produce the etr receipt for. (The amount keyed in should ALWAYS be INCLUSIVE of VAT)

- Press DP4 Button

- Press CASH button to print the receipt.

- Immediately tear of the receipt and press CASH button again to produce a duplicate receipt.

How to do a fuel levy sale

- Please note. we map either fuel or catering levy to DP4 depending on the customer. If you did not buy the Machine from us, please confirm how the two taxes were mapped on your etr machine before following this manual.

- Turn on the machine. (The power button is located at the back of the etr machine next to the charging port).

- Ensure that the screen is displaying CLERK 1

- If on another screen, press the Red C Button until the screen displays CLERK 1

- Now key in the Amount you want to produce the etr receipt for.

- Press DP4 Button

- Press CASH button to print the receipt.

- Immediately tear of the receipt and press CASH button again to produce a duplicate receipt

Please Note

Amount entered at one instance should range between (Kshs 10.00 – Kshs 9,999,999.00). In-cases where the amounts are more than Kshs 9,999,999.00, you expected to split the amount in such a way its less than 9M.E.g your amount is 20M, You can split the amount like 9M + 9M + 2M = 20M.Way of entering. Enter the first amount 9M then press (DP1/DP5– ) if its VAT inclusive, if is not VAT inclusive then (DP2/DP6 *), then Enter the second amount following the same procedure and then the third amount. Once you have entered all the amounts press SUBT Button to confirm the Computation, if the amount displayed is correct then press cash to complete your sale and get a Fiscal receipt. If the total computation is incorrect press SHIFT Button and then press (EC/ A.VOID) button. This cancels the transaction. Note you can Only cancel transaction before pressing Cash Button.

In need of further assistance? Give us a call. we offer life time support to you business on purchase of this ETR Machine.

Hive is your single point of contact for all things information Technology. Get in touch with us for: IT Support, Web design, Business emails, web hosting and branding.

15 reviews for Aclas ETR machine

You must be logged in to post a review.

Kahonge Kahonge –

Top notch services. I’m highly impressed. will be returning soon. Though i need assistance in changing thermal roll. please assist.

johnalexthuo –

Thank you for shopping with us. We will be getting in touch with you shortly to assist you with the thermal roll.

Savaya Faith –

Peris Nduta –

Thanks for the prompt delivery. I really loved the simplicity of this etr machine

johnalexthuo –

We are glad you loved the hive shopping experience.

Benjamin Mwangi –

Received my machine today. keep up with the high professionalism.

johnalexthuo –

Thank you for the positive feedback.

James Kainga –

Easy to use

johnalexthuo –

Glad You loved it sir

Cyrus Pmneshi –

Thanks for the brief training. you deserve a 5 star rating

johnalexthuo –

Thank you for shopping with us. we are always eager to assist you in getting acquainted with any of our products.

Mary mbithi –

Really fast delivery. Can i use this etr machine with another company

johnalexthuo –

Hi. thank you for shopping with us. we really appreciate the business. The is no. regulation allows for one etr machine per company.

Stacy mwangi –

Well received. your rider was quite professional

johnalexthuo –

Thank you for the great feedback. Thank you for shopping with us

Robert Kipkoech –

Hi first of, great service. how do i go about producing a z-report

johnalexthuo –

1. Turn on the ETR machine. (The power button is located at the back of the etr machine next to the charging port).

2. Press the red clerk button. (ETR should display z-mode as the first item on the list)

3. Press CASH button while on z-mode.

4. If promoted for a password, enter 0000 then press CASH button. If not prompted for a password. Skip this step.

5. Your etr machine should now be displaying Daily z on the screen.

6. Press CASH button to produce your daily z receipt.

Joan Wamburu –

Mozart_ke –

Eddie ochieng –

Great etr machine

Richie nduma –

Kevin kinaro –

Very fast delivery. I’m impressed ☺️

Stacy kemunto –